Three leading industry experts are teaming up to provide holiday cottage and complex owners from across Devon and Cornwall with an informative free seminar in October.

The event, which will bring together specialist speakers on digital marketing, holiday home insurance and the buying, selling and development of holiday cottage complexes, will be held on 30th October 2018 just a minute off the A30 dual carriageway on the Devon / Cornwall border.

The event, which will bring together specialist speakers on digital marketing, holiday home insurance and the buying, selling and development of holiday cottage complexes, will be held on 30th October 2018 just a minute off the A30 dual carriageway on the Devon / Cornwall border.

The line-up of speakers will include Mark Worden from MiHi Digital, an experienced online marketing and tourism expert, Mark Lavington of Boshers, one of the country’s leading providers of holiday home insurance and Nick Smith, Manager of Stags Estate Agent’s holiday complex team who specialise in the marketing of leisure complexes for sale and development.

Mark Worden from MiHi Digital said “It’s been a great summer for many holiday homeowners across the South West with the fantastic weather driving tourists to the region in their droves. At this event I’ll be giving some helpful tips on how cottage owners can increase the chances of re-booking and also boost bookings once the sun has gone and we head into the shoulder and winter season.”

Mark Lavington from Boshers said “The meteoric rise of the sharing economy and online platforms such as AirBnB has fuelled a boom in holiday letting. This rapid growth has resulted in a spotlight being shone on the whole self-catering industry highlighting both good practice and shortfalls in guest safety. Now is a good time to take stock, review compliance with legislation and consider your insurance cover. The event offers an ideal opportunity for owners to stay ahead of the curve.”

Nick Smith from Stags said “The leisure marketplace is constantly changing so I’ll be highlighting some of the current trends and offering guidance when it comes to maximising the sale value of leisure businesses through areas such as maintenance, occupancy, accounting and compliance with current regulations.”

For more information on this holiday cottage and complex owners event including timings and topics please click here or to book your place please call 01566 232323 or email hello@mihidigital.co.uk

Martin Dorey, founder of the #2minutebeachclean, said, “It is very special for us to have a presence on Lundy Island. It is a beautiful island that is well loved by many, me included! I have cleaned the beach there myself when I have visited and know that even marine reserves like Lundy need a little extra help clearing marine litter. We are so very grateful to our friends at Boshers for supporting our beach cleaning campaign, and for enabling us to enable Lundy’s visitors to do their bit to keep it pristine. Thanks also to the staff at Lundy for helping to make this happen. It’s brilliant!”

Martin Dorey, founder of the #2minutebeachclean, said, “It is very special for us to have a presence on Lundy Island. It is a beautiful island that is well loved by many, me included! I have cleaned the beach there myself when I have visited and know that even marine reserves like Lundy need a little extra help clearing marine litter. We are so very grateful to our friends at Boshers for supporting our beach cleaning campaign, and for enabling us to enable Lundy’s visitors to do their bit to keep it pristine. Thanks also to the staff at Lundy for helping to make this happen. It’s brilliant!”

Technology continues to change the way in which we do things and the way we conduct our everyday lives. It can make things easier, simpler and quicker to do, and once the change has happened it can be hard to imagine a time in which it didn’t exist. Just think about the following for a second:

Technology continues to change the way in which we do things and the way we conduct our everyday lives. It can make things easier, simpler and quicker to do, and once the change has happened it can be hard to imagine a time in which it didn’t exist. Just think about the following for a second:

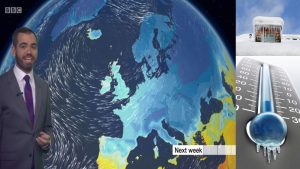

Holiday homeowners please be proactive as the country braces itself for a big freeze and snow for the remainder of February.

Holiday homeowners please be proactive as the country braces itself for a big freeze and snow for the remainder of February.

When it comes to culture and history there are few places in the world that can compete with England; it’s rich and unique tapestry of tradition attracts millions of visitors from around the world every year. Historic England in partnership with our

When it comes to culture and history there are few places in the world that can compete with England; it’s rich and unique tapestry of tradition attracts millions of visitors from around the world every year. Historic England in partnership with our

In the 2016 Autumn Statement, the Chancellor confirmed an increase of 2.0% in the standard rate of Insurance Premium Tax (IPT). [The tax paid each time an insurance policy is purchased in the UK]. The increase is effective for new policies and renewals due on or after the 1st June 2017.

In the 2016 Autumn Statement, the Chancellor confirmed an increase of 2.0% in the standard rate of Insurance Premium Tax (IPT). [The tax paid each time an insurance policy is purchased in the UK]. The increase is effective for new policies and renewals due on or after the 1st June 2017.

Recent figures from VisitEngland have painted a pretty rosy picture of the tourism sector South of the border. So it’s encouraging that the latest indications are that this rude health also extends to

Recent figures from VisitEngland have painted a pretty rosy picture of the tourism sector South of the border. So it’s encouraging that the latest indications are that this rude health also extends to

Many

Many